How it works

Performance Bonus Rate

How we determine the Performance Bonus Rate

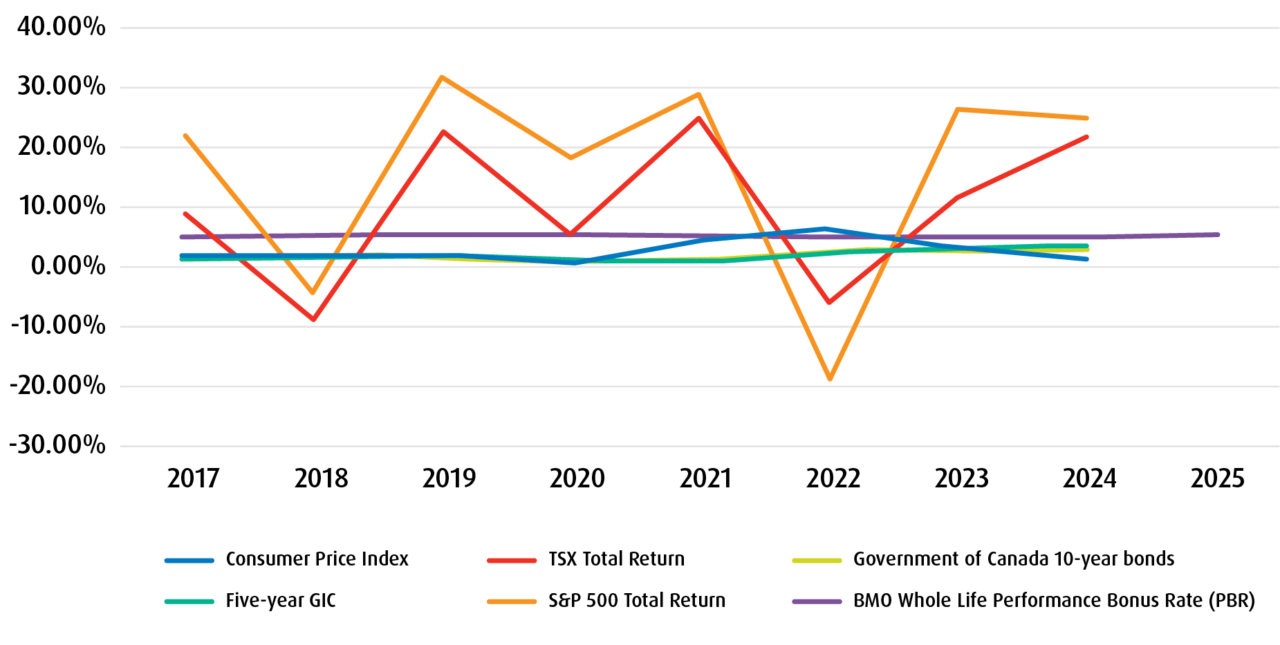

The Performance Bonus Rate takes into account the rate of return of a portfolio2 of fixed income investments and enhanced equity investments designed to target higher overall portfolio yields. To reduce the year-to-year fluctuations (i.e. volatility) of the Performance Bonus Rate, BMO Insurance uses a smoothing formula with a goal of generating more stable, long-term returns.

Sources:

Government of Canada 10-year bonds, June 6, 2025, Bank of Canada.

S&P 500

S&P/TSX Composite Index total return.

Five-year guaranteed investment certificate (GIC) returns are based on nominal yields to maturity.

Source: Financial market statistics, Bank of Canada. Table: 10−10−0145−01.

Consumer Price Index information is taken from Statistics Canada, January 1914-May 2025.